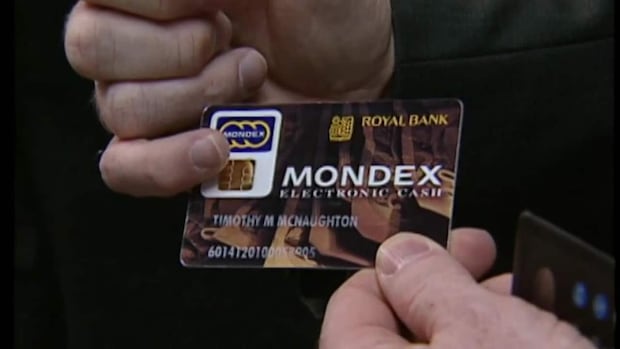

The Mondex electronic money card hoped to make cash obsolete

Guelph, Ont., was a testing ground for new payment method in 1997

In the Ontario city of Guelph, it seemed paying for things with cash was on its way out in 1997.

Bills and coins weren't giving way to credit cards or bank cards. Both of those forms of payment had existed for years.

Debit cards were still a relatively new way to pay for things. But now there was a fourth option involving a plastic card.

"The Mondex card has been test-marketed in Guelph since last September," said CBC reporter Simon Dingley on Feb. 13, 1997.

He said some American and European cities were also using it.

Electronic cash card

Dingley caught up with Lee Phillips, a Guelph resident and a "coffee fiend" who indulged his coffee habit thrice daily at Guelph's Capistrano Cafe.

He didn't need to search his pockets for change; rather, he used his Mondex card to pay via a dedicated Mondex terminal.

The coffee shop was among the 90 per cent of local businesses that accepted payments by a Mondex card, the company had told Dingley.

No cash 'hassles'

The cafe's owner was on board with Mondex, telling Dingley his sales had recently seen a 10 per cent boost because of the card.

"We don't deal with change, the transaction is quick," he said. "My deposits are quick and easy. It's just like dealing with cash, but without the hassles."

The card's chip allowed consumers to transfer money from their bank accounts. The banks charged a fee, but store transactions were free for the user.

Mondex also worked in vending machines outfitted with a card reader.

Paying with plastic using a card terminal, and the convenience of going cashless, is now familiar to Canadians. But the Mondex card had another feature that never caught on.

Money by phone

"You can also get electronic money over the phone," said Dingley, as a card was inserted into a slot on a pay phone and a screen displayed the balance, then showed a menu of options.

A spokesperson for Mondex drove home the point that Mondex wasn't a credit card.

"[With Mondex] you take the cash out of your bank account and you can only spend what cash you have on your card," he said.

"Whereas a credit card is a line of credit that allows you to spend somebody else's money and pay it back later."

Summing up, Dingley said Mondex planned to expand to other parts of southern Ontario and to Vancouver by the following year.

"Mondex predicts it'll have 10 million cardholders by the turn of the century," he said.

In October 1998, the Globe and Mail reported that Mondex had "pulled the plug" on its Guelph test due to its failure to secure backing from three banks — Toronto-Dominion, Canada Trust, and Bank of Montreal.

It said CIBC, which had been a financial supporter, had already announced it was abandoning the Mondex experiment "because the initiative lacked critical mass."

Cash payments declining

In November 2023, Payments Canada — which describes itself on its website as "a public purpose organization that owns and operates Canada's payment systems" — said "cash use has significantly declined over the last six years from 2017-2022, with a 59 per cent decrease in the volume of cash payments."